Civilizational collapse via hyper financialization

A few days back I was purging paper documents. What I found was a sales & purchase agreement made in 1989. It was for the family house dad bought, the very one they lived in right until the end. Friends and family still asks me what I do with that house today.

I remember now why I kept this document despite its uselessness. It was a big financial milestone for dad for have scored this house. This was hardly other assets in his portfolio so this house was meaningful on many levels. This was common among middle class household; houses were made for residence, a habitat that meant something.

About ten years back I bought my first property. It was only slightly more meaningful than a bus ride.

The place was a dingy-ass condominium auctioned off by the bank. I had no intention of staying in it. This whole move was merely an investment vehicle because I didn't know where to park the cash I had. I hardly knew what investing is about. Bitcoin was still ultra risky at that point, I only bought as much as I could lose. Owning a property hoping for capital appreciation was the conventional idea of being 'responsible'. In fact my folks found it more meaningful that I purchased a property that I had to bring them to visit the unit after I got it furnished.

That's a rightful but outdated sense of romanticism corrupted by wide scale financialization.

When objects get turned into instruments of debt to extract future profit, that's financialization. Object may refer to a car, or the future earnings of an individual. That's my limited definition; by itself financialization is like any technology, it's ethically neutral.

If you bother to peek under hood of accounting books, financialization is now everywhere. When a technology as abstract as finance is deployed across the board, the user-end implications are enormous.

Under such operating system, any given person has to understand a lot more finance just to stay afloat to maintain his social and financial status. The world is a treadmill that's running much faster than before; it's questionable if runners are on it are better off.

The domain of finance is evolving faster than what most people are willing to keep up.

I wish I don't have to know about yield curve control, central bank policies, perpetual swap contracts, eurodollar supply crunch and countless man-made nonsense like that. But I do, because I don't want to be exit liquidity when shit hits the fan. That's as far as my finance-bro voice goes.

Where there's a problem though the entrepreneurs will provide the solutions. Additional products are created to abstract away complexities. Picking stocks and bonds are too difficult for you? Let us bundle all these together, you just buy this one thing and everything will be managed for you. Just sign here.

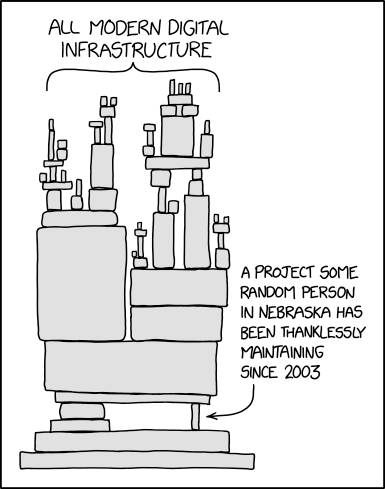

In software engineering these are called layers of abstractions. You write helper code to make things easier to use, and pretty soon this helper code becomes critical infrastructure used everywhere. The layers can go on and on. This is how dependency hell happens.

Modern programmers basically lose touch with what code the raw chips actually run. Similarly, even well-informed people lose touch with what their financial products actually contain.

Under the weight of complexity, people do the next best thing available: defer to authority. At best these are mildly autistic finance geeks who know what they are doing; at worst they believe politicians who pretend to know what they are doing (look no further than price controls policies).

Each layer of financial abstraction is operated by different authority made out of highly fallible humans. The entire system wound up looking like this:

The pillars of civilization run on Jenga pieces like these. The whole system is as fragile as much as they are complex.

At some point (before or after the system breaks) the kids will decide the maintenance effort is impossible, the personal cost too high, opt out of 'modernity' en masse and have a go at simplicity.

Civilization gets to reboot with a clean slate; a similar cycle may repeats itself except at a more rapid pace.

There are only two things worth considering going forward:

- If this is a forgone conclusion, should this process be made faster or slower?

- If this is not inevitable, how can the system be redesigned to discourage financialization?